General Contractors Moving Toward Automation

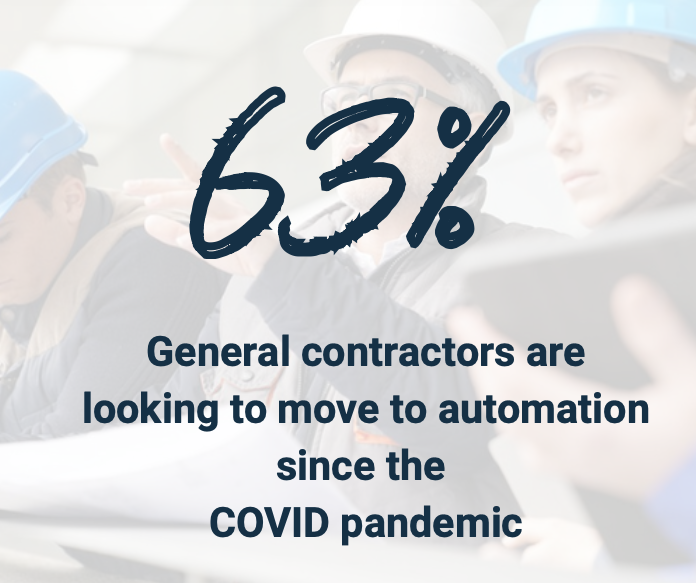

The construction industry has been evolving more rapidly since the COVID pandemic and one of the ways companies are streamlining operations and gaining efficiencies is by automating their finance management.

According to a recent GCPay survey, 63% of general contractors are looking to software automation to help improve operational efficiencies due to the increasing number of projects since the pandemic.

One of the areas within accounting departments most affected is accounts payable. Subcontractors responding to the same GCPay survey mentioned a 54% increase in electronic payment as opposed to traditional paper check payments. For general contractors, there are many benefits to moving to electronic fund transfer (EFT), and obvious advantages for subcontractors to get paid electronically as well.

ePayment & Waiver Exchange vs. Paper Check

In 2022, paper checks are still the primary method of payment used by most general contractors for subcontrator pay apps. The key challenges with this payment method are:

- Takes too long to process and pay subs in a timely manner

- accounting management is more difficult due to lack of transparency

- The extra costs associated with labor, materials, and postage

Why GCPay?

GCPay software already eliminates double entry into your ERP for pay apps, manages compliance documentation, and lien waiver exchange, and performs subcontractor management such as tier vendor waivers or owner billing. So, adding electronic payment to pay subs is a feature that eliminates one more headache for accounting departments while saving costs, decreasing time, and adding transparency to all sub payments. Besides making the payment to subs easier, faster, and more secure…GCPay manages the unconditional lien waiver exchange so a general contractor has what they need as soon as payment is received. No longer will a general contractor have to reach out to subcontractors to obtain key waivers on every pay app for all projects.

ePayment & Waiver Exchange vs. ACH

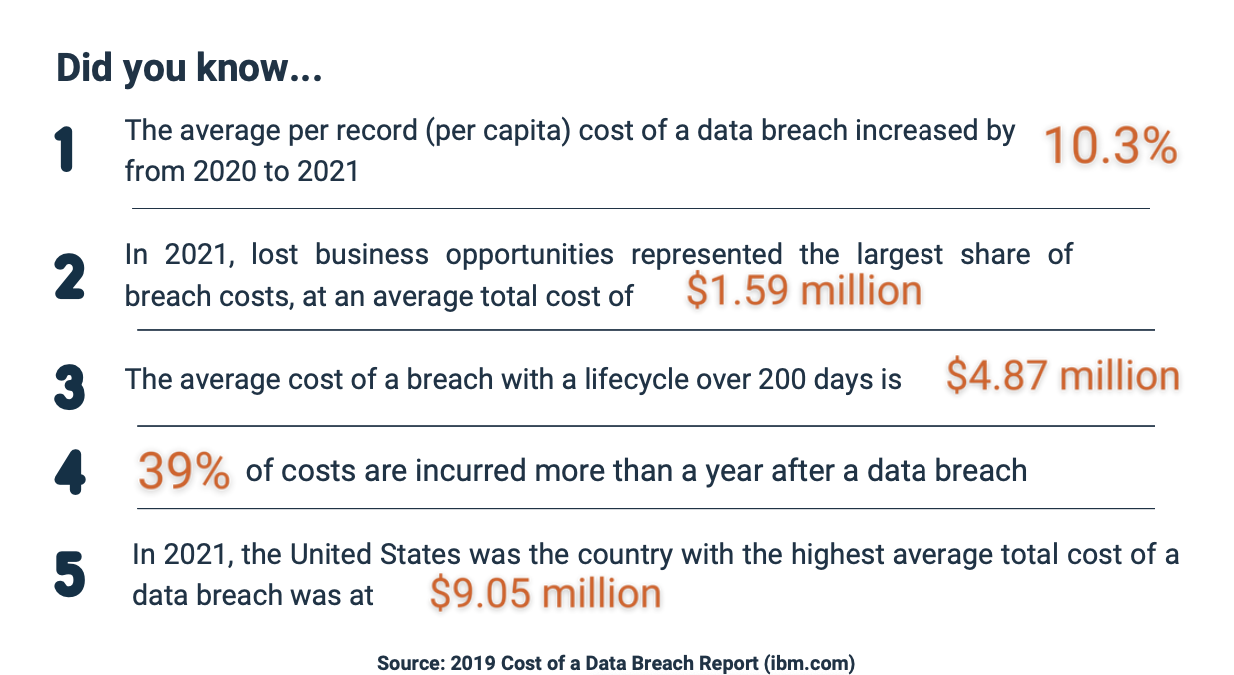

Collecting and storing subcontractor bank details is risky business, one data breach could expose personal identification information holding the general contractor liable for damages. Email or fax transmission of data is unsecure and requires manual entry leading to potential errors and processing delays.

Why GCPay?

GCPay’s ePayment & Waiver Exchange will manage the collection and storing of all subcontractor bank details so that the burden and risk is removed from general contractors. This benefit saves time and more importantly potential expense from exposure to a data breach if key bank details would be obtained during a cyber attack.

How GCPay’s ePayment & Waiver Exchange Works

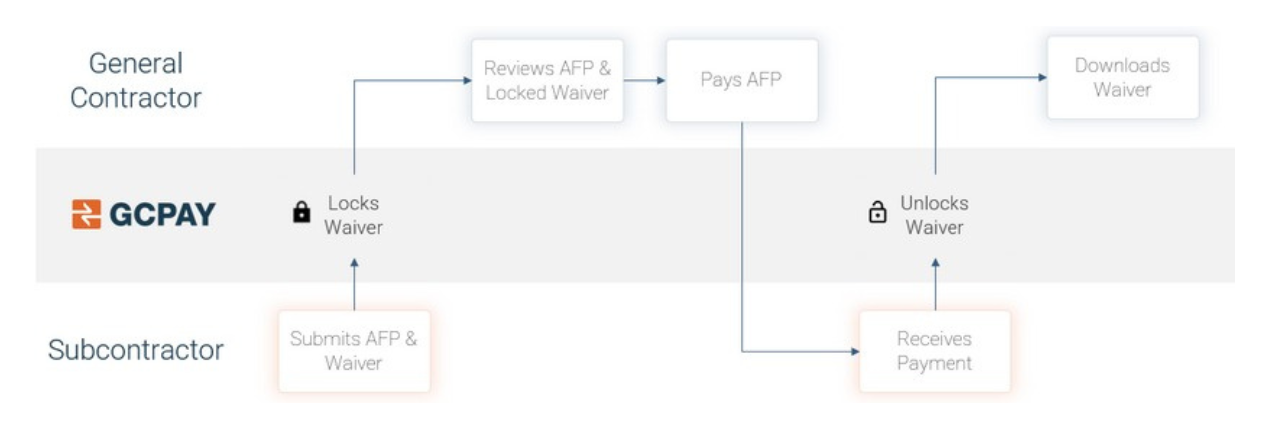

General contractors can choose which contractor to issue ePayments to, on each project. The process is simple and gives ultimate control to the general contractor. First, the GC will create a batch of all approved pay apps they’d like to escrow for ePayment. At that time, all associated lien waivers (already signed by the subcontractor) are moved into escrow as well and watermarked as “unofficial until paid”.

Next, the general contractor will decide when to release the funds out of escrow, at which time each subcontractor will receive their payment electronically in their designated bank account in one or two business days. Upon receipt, the unconditional lien waiver currently in escrow becomes available for GCs to download without a watermark, making it an official document. The reporting and notifications to both subcontractors and general contractors allow for transparency throughout the transaction.

To learn more about GCPay or the ePayment & Waiver Exchange feature, please go to GCPay.com.