Executive Summary

The slow down in construction projects as a result of COVID may be in the rearview mirror but it had lasting affects on how general contractors are managing construction projects.

This report goes into detail on what has changed and what led the majority of contractors to make a change in how they manage payments for construction projects.

GCPay surveyed 240 general and subcontractors in North America to provide their input in how they managed their payments prior to COVID, and what changes they’ve made since, and why.

COVID Impact

Like most areas of construction, finance and accounting was also negatively affected. 15% of general contractors surveyed reported having to downsize their accounting/finance workforce due to less projects to manage.

Response to COVID Impact

How these general contractors looked to adjust to the increasing ramp in project post- COVID was most telling. Of those who had to reduce their workforce, 63% looked to automation and software technology to help them become more efficient with construction finance management as volume grew.

Where Automation Was Implemented

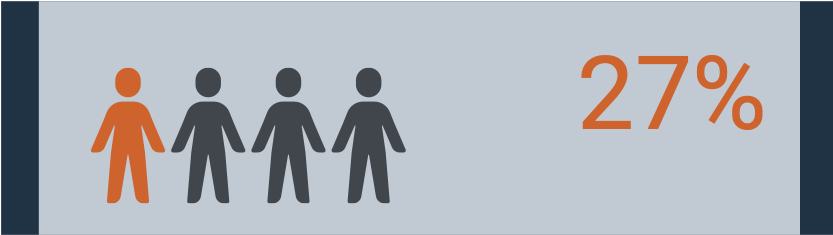

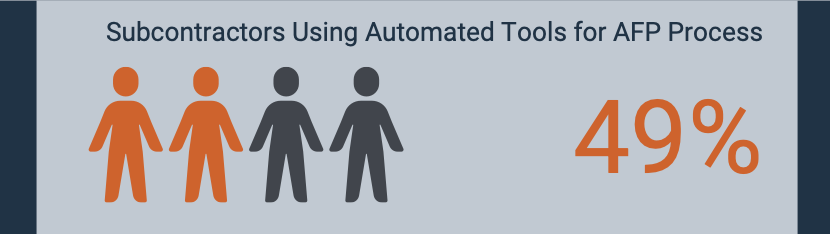

There are two key areas where general contractors have focused their attention for automating financial management. One is managing the process by which they collect applications for payment from subcontractors. According to all general contractors surveyed, 27% of them have moved or are looking at moving to an automated solution for pay app management since the pandemic.

General Contractors Migrating to Automated AFP Process

This area of finance management makes sense because the majority of the general contractors report an average of >20 hours per month spent managing this part of their business. Most identified collecting information from subcontractors as the largest component of the time spent.

Where Automation Was Implemented

The other key area where general contractors took advantage of automation, is with electronic fund transfer as payment method for subcontractors. Since the pandemic, general contractors have increased the number of pay apps paid through ePayment by 40%.

The growth rate of ePayment use from the point of view of the subcontractor shows an even greater increase since the COVID pandemic. Subcontractors surveyed responded with a 54% increase in payments received via electronic fund transfer since the COVID pandemic.

Why the Increase in Automation Now?

General contractors were asked why they were looking to automate this process now and the answers were wide ranging, but all came down to central themes around time savings from communicating with subs, and ensuring accuracy on all submittals. Below are the most popular responses from general contractors in the survey.

General contractors have suggested that pandemic lessons learned, include the important of efficiency in processes. With technology, the ability to save time completing tasks also can be combined with ease of scalability which was realized as construction projects began ramping up as North America came out of the COVID restrictions.

Flexibility in operations allowing for easier sustainability of a reduction in projects is also appreciated now more than ever by general contractors. This survey proved fruitful in understanding what aspects have changed within finance management, and why.